CTOS

Know Your Credit Status

Always know your credit score to increase your loan opportunities.

Free Gifts to Members

Members can receive 2 free CTOS reports per year at no additional cost.

Accurate Credit Rating

Helps you optimize your loan application to increase your chances of approval.

What is Included in the CTOS Report?

The CTOS report contains the following key information to help financial institutions quickly assess your credit situation:

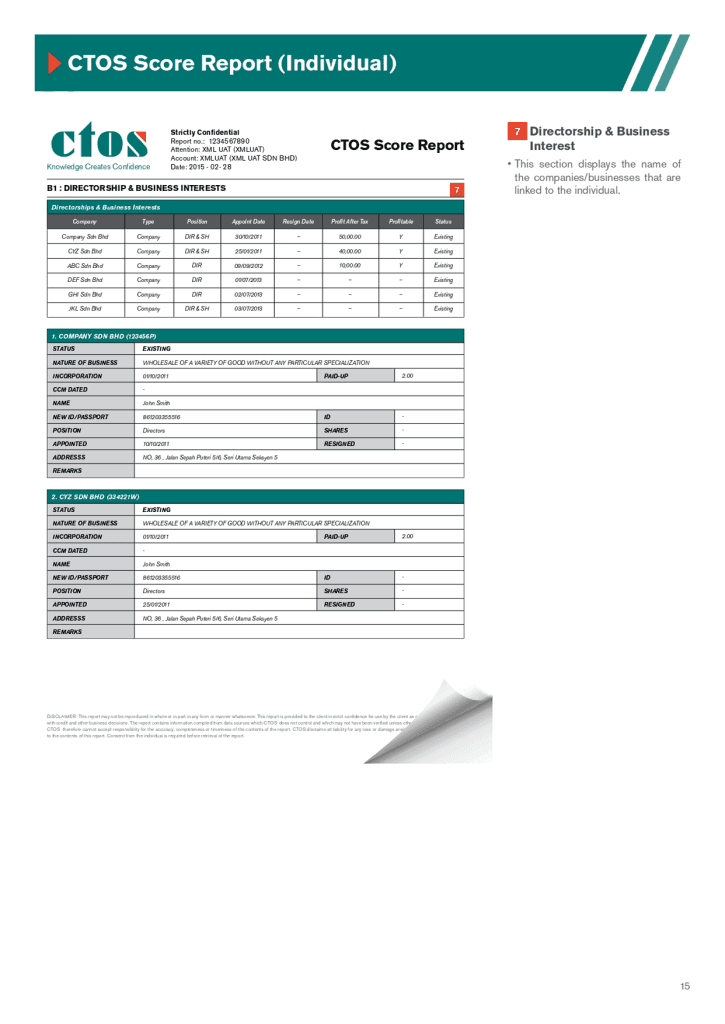

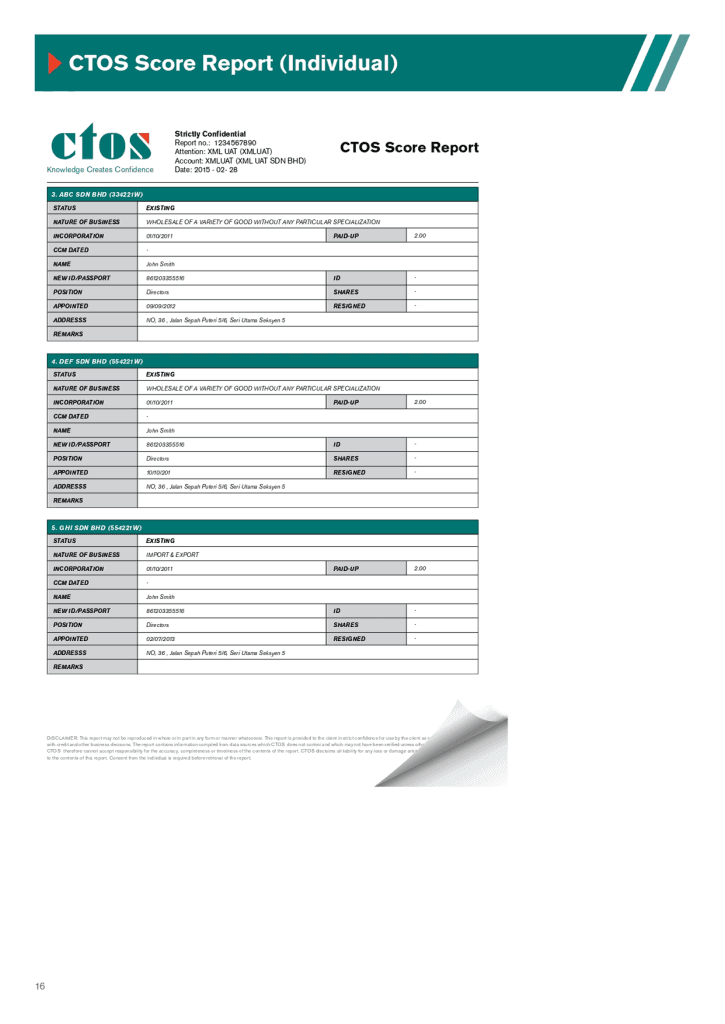

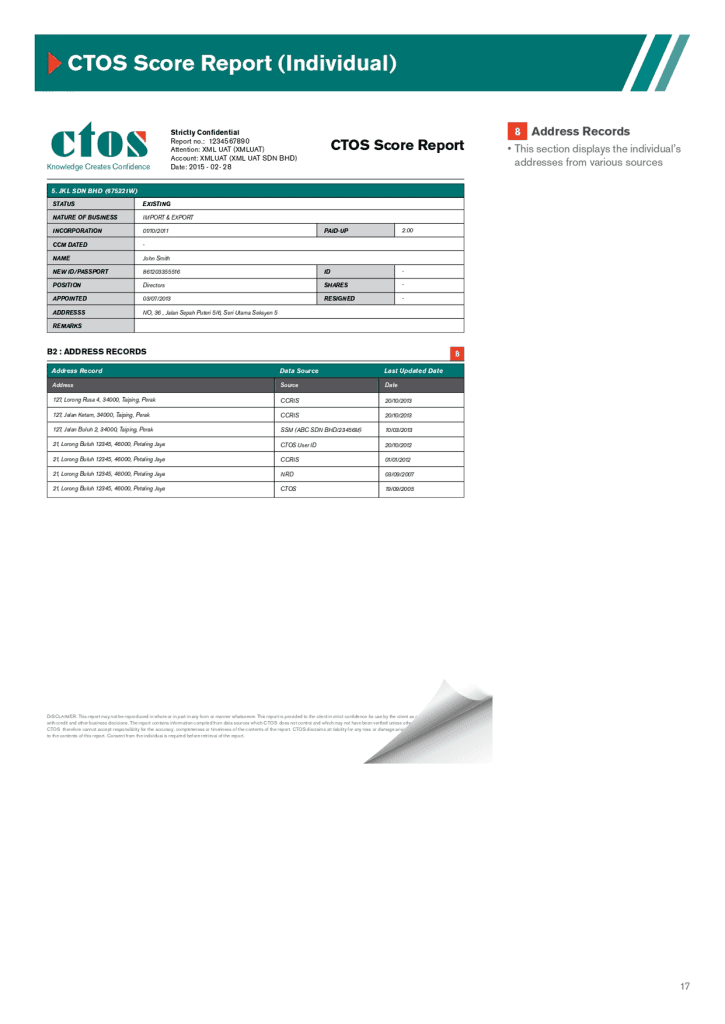

Personal Information

Basic details such as name, identity card number, etc.

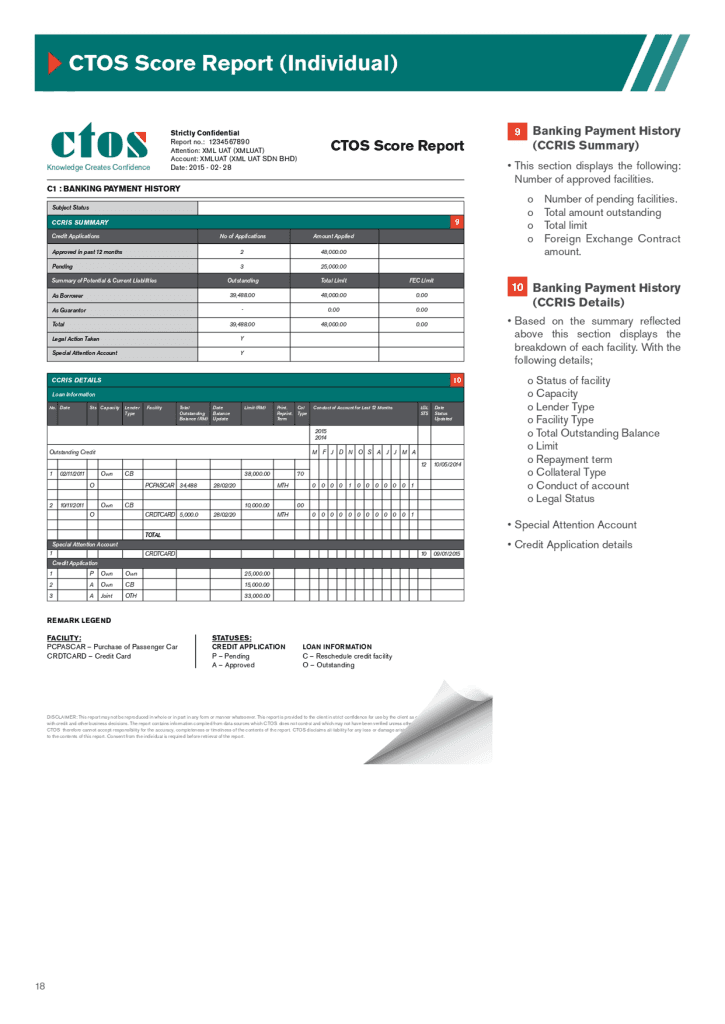

Credit Record

Past loan records, repayment status.

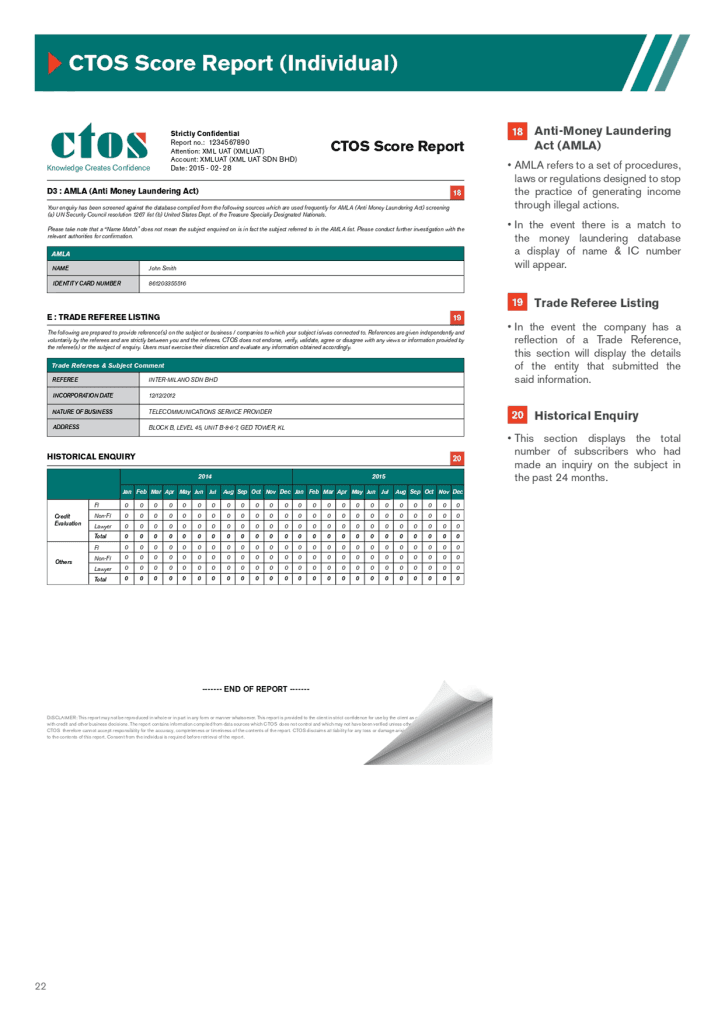

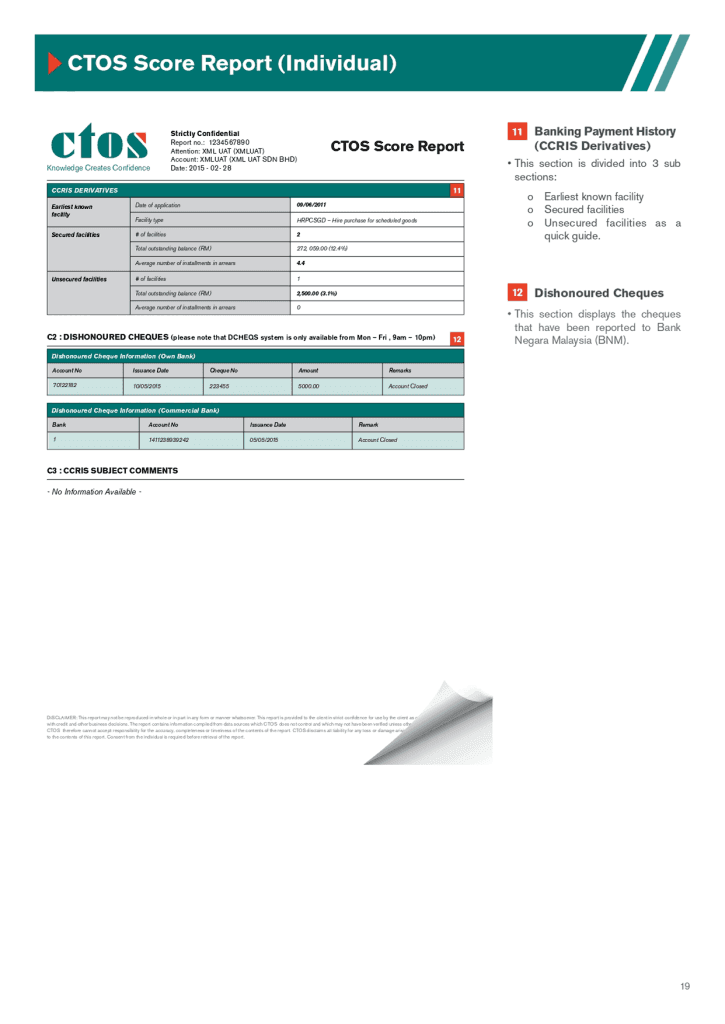

Payment Failure Information

Whether there is any outstanding debt or a record of late payments.

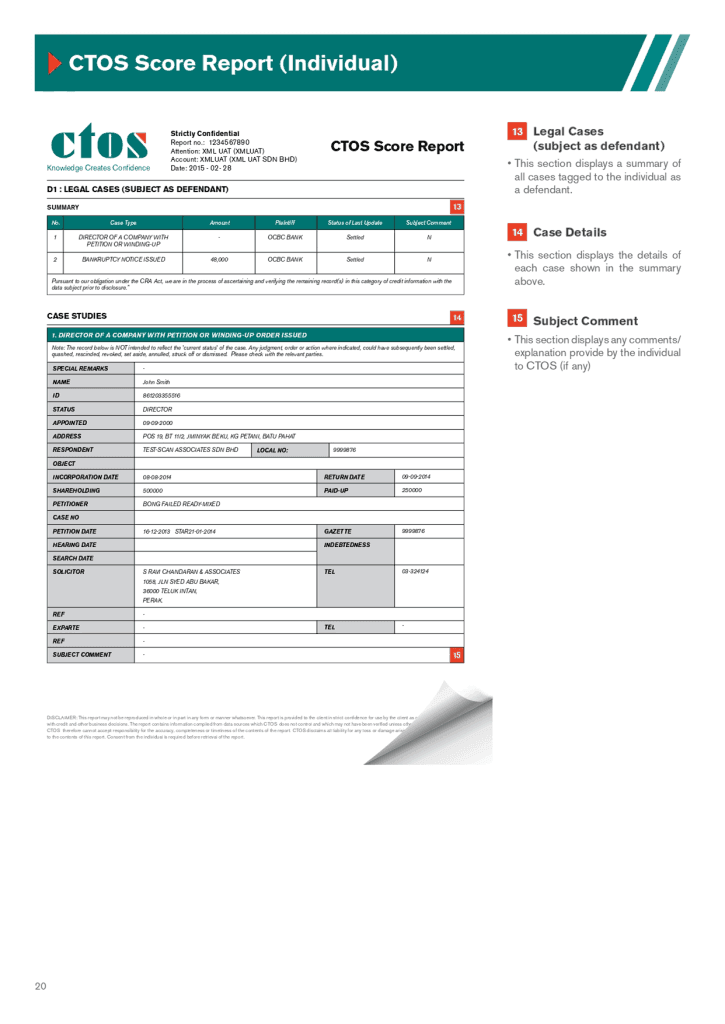

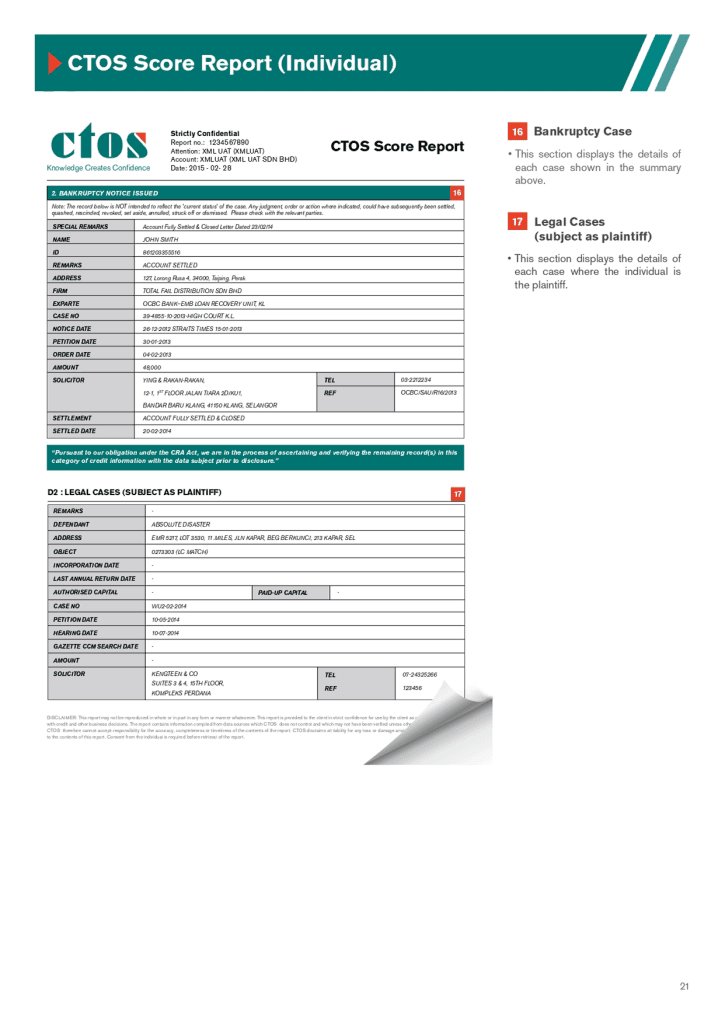

Legal Claims

Legal disputes that may affect your credit score.

Send Information

Go to the product page, select your subscription plan and fill in the required information.

Make a Purchase

After filling in the information, select the product and add it to the cart to make payment.

Get CTOS Report

After successful payment, you will receive an email from the seller with a download link for the CTOS report.

Frequently Asked Questions

No. Requesting a CTOS report is part of personal credit management and will not impact your credit score.

Yes! Lending institutions will refer to your CTOS score. A good credit record can help increase loan approval rates.

As a member, you can get 2 free CTOS reports every year, ensuring your credit status remains transparent. It is recommended not to get both reports in a short period of time as it will not give much improvement to your CTOS score.

Become a Member , Enjoy Exclusive Credit Management Services!

Know your credit status early, increase your chances of loan approval! As a member, you can get 2 free CTOS reports every year, helping you stay informed about your credit score, plan your finances better, and increase your chances of loan approval.